Have medical bills you can’t pay? You’re not alone. You’re in the company of some 137 million Americans. The problem is so prevalent that medical debt is the number one source of debt collections—beating credit cards, utilities, and auto loans combined.

Being unable to afford the cost of your healthcare is a stressful situation to find yourself in, but take heart: There are many actions you can take to tackle medical debt, no matter how impossible it may seem right now. We’ve done the research and consulted with experts, and below, we’ll detail eight steps to take if you can’t pay your medical bills.

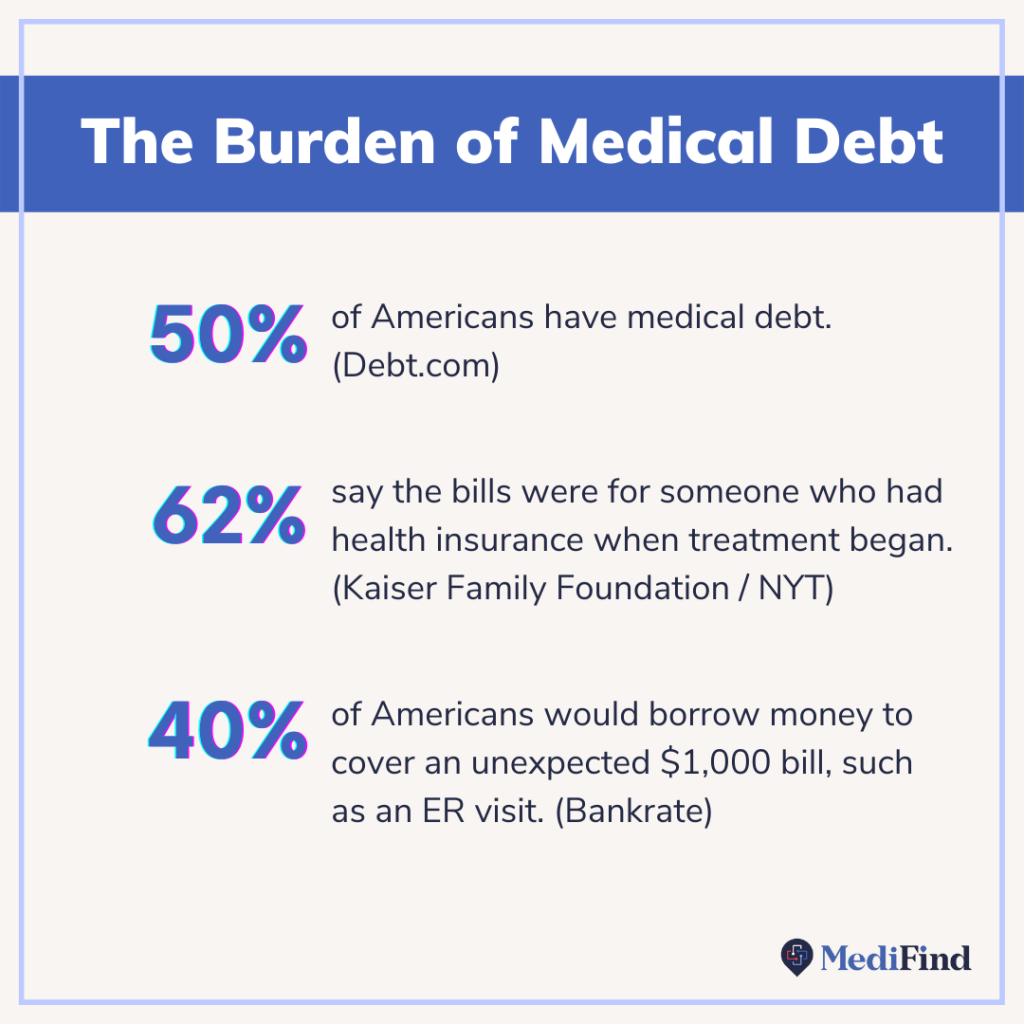

But first, just how bad is medical debt in the U.S.? Let’s look at some statistics.

7 Statistics That Highlight The Magnitude of the Medical Debt Problem in the U.S.

- 50% of Americans have medical debt. (Debt.com)

- Nearly 18% of Americans have medical debt in collections. (JAMA)

- Diagnostic tests are the number one source of medical bills (24%), followed by hospitalization (19%) and the ER (18%). (Debt.com)

- 61% of Americans who have struggled to pay medical bills say they’ve been late making a medical bill payment. (Kaiser Family Foundation/New York Times)

- 33% say that the medical bills they’ve had problems paying are ones that built up over time, such as for treatment for chronic illness. (Kaiser Family Foundation/New York Times)

- While those without health insurance are more likely to struggle to pay medical bills, 62% say the bills were for someone who had health insurance when treatment began. (Kaiser Family Foundation/New York Times)

- Nearly four in 10 Americans would borrow money to cover an unexpected $1,000 bill, such as an ER visit. (Bankrate)

What Happens If You Don’t Ever Pay Your Medical Debt?

While medical debt is enough to make you want to curl into a ball and ignore the calls and letters from the parties trying to collect—the worst thing you can do is ignore the debt. This is not one of those things that will go away on its own. It’s better to speak with the hospital or debt collector and try to negotiate (which we’ll discuss more below) than to ignore them, as this can do serious damage.

Here are just a few consequences of ignoring medical debt:

Your debt gets sent to a collections agency

When a hospital is unable to collect on a bill, they have the option to sell the debt to a collections agency. When that happens, you’ll start receiving phone calls and/or mail from the debt collector to try to get you to pay.

Collections on your credit report can ruin your credit score

Debt collectors report the collections to credit bureaus, and that lowers your credit score by a substantial amount. This, in turn, could dash your hopes of buying or renting a home.

You could be sued for unpaid medical bills

If they’re unable to collect on your debt, the hospital or collections agency could decide to sue you. Lawsuits are expensive and an additional emotional burden on top of your medical debt.

You could lose a portion of money you earn in the future (wage garnishment)

Some people think they’re lawsuit-proof if they don’t have any money to begin with. But that’s flawed thinking. Even if you do not have money now, if you lose a lawsuit, you could have your wages garnished. That means a portion of the money you earn in the future could be taken away from you and given to the creditor you owe money to (e.g., a hospital).

So as you can see, you do not want to ignore your medical debt. Below, you’ll learn about eight options you have for conquering those medical bills.

What to Do When You Can’t Pay Your Medical Bills

1. Check your EOB and bill for errors.

When you get a medical bill in the mail, don’t assume that the amount it shows is the amount you have to pay. Billing and coding errors are quite common, and the only way you can avoid paying when you don’t have to is if you know how to spot these errors.

The first thing to know is that every time you receive medical care, each service has a corresponding procedure code. This code is what determines cost and is how your insurance company knows what to cover. You can Google the meaning of these codes.

The second thing to know is how the Explanation of Benefits (EOB) works. This is the letter you get in the mail that reads “THIS IS NOT A BILL.” Many of us throw these things away—but don’t do that!

The EOB helps you in two ways:

- It tells you that your provider submitted the bill to your health insurance.

“And that is so important because the number one mistake we see—and it sends patients into a panic—is providers billing patients directly,” says Caitlin Donovan, a spokesperson for the Patient Advocate Foundation, a nonprofit that provides case management services to people with chronic, life-threatening or debilitating diseases.

When a provider bills an insured patient directly, instead of submitting to insurance, the patient erroneously thinks that they owe more than they actually do. A patient might get $20,000 for a hospital visit, but in reality, their insurance should be covering most of it, and they only owe $400.

“So if you ever receive a bill without your EOB, wait on it,” advises Donovan. Call your provider and ask them if they submitted to your insurance. There’s a good chance that the provider made a mistake and needs you to do something as simple as confirm your address. “And all of a sudden, you’re looking at a bill that doesn’t exist anymore.”

- Compare it to your bill to check for errors. Check your EOB against the bill you get in the mail to make sure you aren’t overpaying for anything. If there is an error with the bill, or you think it’s higher than it should be, the first call should be to your insurance company.

Sometimes, a bill has a coding error, meaning the provider used the wrong code when they submitted the bill to your insurance. In that case, ask your health insurance company what code needs to be submitted in order for the treatment or procedure to be covered. Once you know the correct code, call your provider and let them know. You can say something like, “Hey, it looks like you submitted this incorrectly. I need you to resubmit this bill to my insurance with this specific billing code.”

Other things to look for in your medical bill:

Adria Goldman Gross is the founder of MedWise Insurance Advocacy, where she helps her clients reduce, and sometimes eliminate, medical bills. As such, she’s an expert at scrutinizing bills for errors, which she advises every patient to do when faced with a bill they can’t pay.

Here’s what she recommends asking yourself while looking at your bill:

- Did I actually receive these services? If, for example, there’s a code for a CT abdominal scan on your hospital bill, but you never received a CT scan, you can contest this and should not have to pay for it.

- Was I charged a reasonable amount for this service? To check what the going rate is for a procedure or service, Gross recommends the Medicare website’s physician fee schedule, where you can look up the customary charge for specific procedure codes. Another resource for finding the fair price of treatments is Healthcare Bluebook. If the amount charged to you is much higher than the listed rate, call the provider and use that information to negotiate it down.

- Was I billed more than once for the same service? This is known as double billing, and Gross says she sees it a lot. If this happens to you, contest it with the provider.

As you can see, tackling medical debt begins with knowing how to read a medical bill and how to correct errors on it.

2. Learn about your legal rights as a patient.

The Affordable Care Act

The Affordable Care Act mandates that nonprofit hospitals provide free or discounted emergency or medically necessary care to patients with low income. And there’s about a 50% chance that your hospital is a nonprofit. According to the American Hospital Association, nearly 3,000 (or roughly half) of U.S. community hospitals are.

So who qualifies as “low income?” The threshold varies by state and by hospital, so Google ”[hospital name and location] financial assistance policy” to find the details for your specific hospital. From there, you’ll need to apply for assistance.

The Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act puts limitations on what debt collectors can and cannot do when contacting you, and yes, it applies to medical debts. For example, the FDCPA states that debt collectors cannot contact you at unusual times (such as after 9 p.m.) or harass you.

If you’re struggling with how to respond to a debt collector, the Consumer Financial Protection Bureau has free letter templates for almost every situation.

No Surprises Act

The No Surprises Act went into effect January 2022 and protects patients from receiving surprise bills from out-of-network providers whom they didn’t choose in a medical emergency. There are some nuances here, but according to The New York Times, the law covers “nearly all emergency medical services, and most routine care.”

3. Appeal any insurance claim denials.

When your health insurance denies a claim, you can appeal it—but few people do. Data from HealthCare.gov shows that Affordable Care Act Marketplace consumers appealed only about one-tenth of one percent of their in-network claim denials in 2019. And their odds were pretty good: Appeals were successful 40% of the time.

If your claim was denied, call your insurance company and ask them how you can complete the appeals process. You will likely need to work with your medical provider on submitting information for the appeal.

4. Call the hospital billing department.

If you receive a hospital bill you can’t afford, call the hospital and let them know. Yes, you can negotiate your hospital bills.

“That can be a magic phone call,” says Donovan. She’s seen people with a $30,000 bill get that down to zero just by talking to the hospital. “That’s not going to be the most frequent thing that happens. But it happens frequently enough that it should be a phone call you make before you consider spending money, when you may not have much to begin with.”

Why does this happen? Hospitals know that if they cannot collect on a debt, they can write it off or sell it to a debt collector. But writing it off means they get no money toward that bill, and selling it to a debt collector means they’ll only get pennies on the dollar. Therefore, it’s in the hospital’s best financial interest to work with you on lowering that bill or getting as much as they can from you now, even if it’s not 100% of the bill.

Here’s what to do when you call the hospital billing department:

Step 1: Ask about the hospital’s financial assistance programs.

“A lot of people qualify for financial assistance,” Donovan says. “But the hospital won’t offer it upfront. You have to ask.”

These financial assistance programs are available to people with low income, and the threshold is different for each hospital, so be sure to ask for details.

If applying for a hospital’s financial assistance is too overwhelming for you, the nonprofit Dollar For offers help with the application process.

Step 2: Ask for a payment plan. If you’re not eligible for assistance, ask them if you can work out a payment plan. This will likely be installment payments over the course of several months with interest, meaning, in total, you’ll end up paying more than the current balance for the convenience of having it broken up into smaller chunks over time.

Step 3: Ask for a discount for paying in cash now. A hospital would rather have as much money as possible right now than have to chase you down for payments over the next several months. Many will offer a cash discount. So if you have the cash, this might be worth it, as you’ll pay a lower amount overall.

5. Enlist the help of a patient advocate

Broadly speaking, a patient advocate is anyone who fights for your best interests; it can be a friend or a family member, for example.

But formally speaking, there are patient advocates who offer their services for free, such as the case managers available through the Patient Advocate Foundation (PAF), a nonprofit. To qualify for PAF case management services, you must be a U.S. citizen or permanent resident with a diagnosis of a serious health condition, among other requirements.

If you don’t qualify for a program, such as one through PAF, see if you can get help from someone you know.

“People have a hard time asking for help, but you should let someone help you,” says Donovan. Whether that’s a spouse, a family member, or a close friend, allowing someone else to shoulder the burden of making phone calls can be a huge weight off your back while you do the work of recovering. To give you perspective, the Patient Advocate Foundation’s average case takes more than 22 phone calls to complete. Imagine having those tasks taken off of your hands.

6. Seek financial assistance

Government programs

There are many government programs that help with medical bills, including Medicaid and CHIP, Social Security and Medicare, and Medicaid for Adults. Be sure to check these programs’ eligibility requirements to see if you qualify.

Patient Assistance Programs (PAPs)

Many pharmaceutical companies, such as AstraZeneca and Merck, have Patient Assistance Programs (PAPs) to help cover the cost of drugs for people who are uninsured or underinsured and cannot afford their prescriptions. The Asthma and Allergy Foundation of America has a list of PAPs relevant to people with asthma, for example, along with contact information for each.

Medical charities

Below are some charities that offer financial assistance for medical bills, but the list is certainly not exhaustive. You can try Googling for “medical charities [your specific illness].”

- The HealthWell Foundation helps underinsured people with chronic or life-altering diseases pay for copays, premiums, deductibles, and out-of-pocket medical expenses.

- CancerCare Co-Payment Assistance Foundation helps with copayments for prescribed treatments for certain cancer diagnoses.

- The PAN Foundation provides assistance for medication costs, insurance premiums, and transportation expenses for underinsured patients.

7. Hire a medical billing negotiator

If you have a truly massive amount of medical debt and need help, a medical billing negotiator might be an option to consider. Medical billing negotiators are trained professionals who negotiate bills on your behalf for a fee, often a percentage of the amount they save you.

“A medical billing negotiator might be a great idea if you don’t qualify for free assistance,” Donovan says, “and you really need help, and it’s complicated, and it’s a big bill.”

That’s what Gross does for her clients at MedWise. After working for health insurance companies and running a medical billing business, she’s able to use her expertise to find loopholes in ways that a layperson cannot. She worked on one case for a year and a half where her client started with $160,000 in medical debt, and she got it down to $10,000 by negotiating. In another case, she reduced her client’s $127,000 bill to zero by sufficiently proving to the hospital that her client didn’t have the means to pay (the hospital eventually wrote it off).

8. How to minimize your medical bills going forward

Opt for in-network versus out-of-network providers

When you schedule an appointment with a provider, it’s not enough to ask them if they accept your insurance. Take it one step further and ask if they are in-network. Why? An in-network provider has a contract with your health insurance company, meaning your insurance benefits will cover more of the costs for an in-network provider than an out-of-network one.

For example, if you have insurance, a visit to an in-network ENT might be a $60 copayment. But if you go to an out-of-network ENT, your insurance might only cover 50% of the cost after you’ve met your deductible. And with an ENT new patient visit easily costing $300—that’s a big difference.

How do you find out if your doctor is in-network? Many health insurance companies have an online tool to help you locate an in-network doctor, but often, these are incorrect or out of date. Call your insurance company to confirm the provider is, in fact, in-network.

Additionally, you can look up any doctor on MediFind. We take great care to ensure we have accurate contact information, so be sure to give them a call to confirm they’re in-network with your health insurance.

Get a quote before the procedure or test

Call the doctor or hospital and ask for the procedure code that they’ll submit to your insurance. Next, call your insurance and provide them with the procedure code. Ask them how much you will end up having to pay.

Shop around.

Call different providers and give them the procedure code. Ask what their cash price is for that procedure because, in some cases, the cash price might actually be lower than the price with insurance.

Find the right doctor the first time.

No matter what type of insurance coverage you have, it will always cost less to see one or two doctors than three or four. That’s one reason why finding a doctor with the right experience and qualifications for your specific health condition is so important. MediFind continually assesses millions of physicians on their medical expertise across thousands of health conditions, so you can be sure you’re seeing a doctor with the expertise you need.

There’s Hope for People With Medical Debt

Looking up what happens if you can’t pay medical bills is never a fun endeavor. On the heels of a hospital visit, the last thing anyone wants to do is figure out how they’re going to get out of medical debt.

Sadly, crippling medical debt is one result of a broken U.S. healthcare system. But thankfully, you have options when it comes to tackling your medical debt. It all begins with educating yourself, which you’ve done by reading this article.

The biggest takeaway is that you should scrutinize every medical bill, negotiate as much as you can, and let people help you—whether that’s a friend, a family member, or a case manager.

And before you schedule your next appointment, be sure to use MediFind to locate the right doctor for you. That alone can end up saving you a lot on your next medical bill.